By Betsey Piette

Philadelphia

Published Jul 9, 2011 6:10 AM

Gov. Tom Corbett’s first state budget, with its massive draconian cuts in programs that have benefitted working and poor families in Pennsylvania, leaves little doubt: The corporations that poured millions of dollars into his campaign coffers got their money’s worth.

While insisting on $1.2 billion in spending cuts for education, healthcare, welfare, job training, senior and disabled services, and environmental protection programs, Corbett refused to even consider a tax on Pennsylvania’s booming natural gas industry.

Opinion polls show broad public support for a gas tax. Pennsylvania remains the only state not to tax this industry. Even industry spokespeople have said they would not oppose a limited tax. Yet Corbett vowed to veto any legislation taxing natural gas drilling.

Corbett’s success in last year’s Pennsylvania gubernatorial election was due in large part to the heavy financial backing he received from natural gas drilling companies, eager to take advantage of shale formations like Marcellus and Utica. They are thought to contain massive natural gas reserves worth billions of dollars.

Within the first few months of his term, Corbett took steps to further limit the state’s already weak system of environmental regulation and repealed a moratorium on further leasing of state forest lands for drilling that outgoing Gov. Ed Rendell decreed last October.

In March Corbett established the Marcellus Shale Advisory Commission, comprised primarily of energy executives and contributors to his campaign, to oversee the gas drilling industry. Corbett has said he’ll leave it up to this industry-controlled body to consider if a gas tax is warranted.

Product of Chesapeake Energy

Corbett’s tight relationship with the natural gas industry apparently started long before his 2010 run for governor. It may have played a significant role in turning a relatively obscure politician into a candidate capable of winning statewide office.

Oklahoma City millionaire and “energy mogul” Aubrey McClendon reportedly wrote a $450,000 check to finance Corbett’s run for Pennsylvania attorney general in 2004. That was the major part of $720,000 in contributions from an “obscure campaign committee out of Washington called the Republican State Leadership Committee.” Other RSLC contributions to Corbett’s 2004 campaign can be traced to the tobacco and insurance industries. “The influx of cash helped Corbett narrowly win the closest attorney general’s race in Pennsylvania history and propelled him toward the governor’s mansion, where he has now pledged to turn the Keystone State into ‘the Texas of the natural-gas boom.’” (Philadelphia Daily News, June 29)

In 2004 corporate money was banned in Pennsylvania elections. However, the state did allow unlimited campaign contributions from individuals.

McClendon’s company, Chesapeake Energy, is now one of the largest drillers for natural gas. It also was responsible for two major Pennsylvania gas-well accidents last year and is the target of lawsuits involving natural gas leases in Michigan and Maryland.

In April a blowout at a Chesapeake Energy well in Leroy Township led to hazardous chemicals spilling into a creek that flows into the Susquehanna River and eventually into the Chesapeake Bay.

Chesapeake Energy was represented on Corbett’s Marcellus Shale Advisory Committee until the Pennsylvania Department of Environmental Protection imposed a $900,000 fine on the company for polluting the drinking water of 16 families in Bradford County.

Possible Ponzi scheme

While Corbett has clearly benefited from his cozy relationship with the natural gas industry, questions have arisen lately if investors will be so lucky.

In the June 25 article “Insiders Sound an Alarm Amid a Natural Gas Rush,” New York Times columnist Ian Urbina reported on concerns raised in emails by industry insiders who question “whether companies are intentionally, and even illegally, overstating the productivity of their wells and the size of their reserves.” In April Urbina wrote a four-part series on environmental hazards stemming from natural gas drilling in Pennsylvania and the state’s lack of adequate oversight.

Urbina notes that the gas industry’s promise of big profits may not match the reality. Drillers are discovering that “fracking,” the process of extracting natural gas from deep underground shale formations, may not be as easy and cheap as promoters claim. He notes, “Many of these emails also suggest a view that is in stark contrast to more bullish public comments made by the industry, in much the same way that insiders have raised doubts about previous financial bubbles.”

One review of data from more than 9,000 wells gathered from 2003 to 2009 found that less than 10 percent of the wells had recouped their estimated costs after operating for seven years.

Some of the gas company industry consultants and analysts who responded to a New York Times survey made comments like “Ponzi schemes,” “Enron moments” and “Reminds you of the dot-coms.”

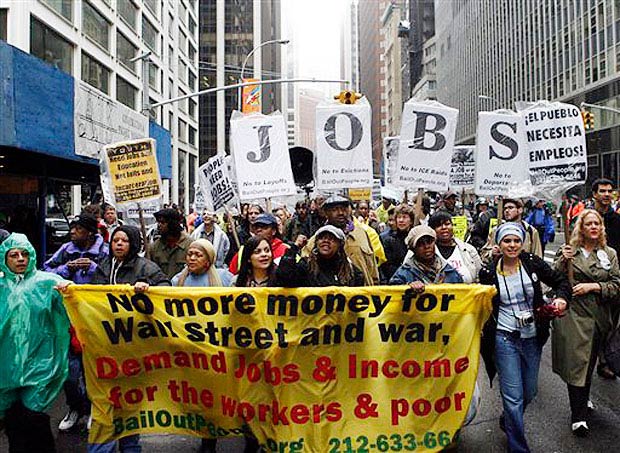

Massive protests set for Sept. 7-8

Nonetheless, the Marcellus Shale Coalition, a powerful lobbying group that continues to promote drilling in Pennsylvania, plans to hold a big industry trade show dubbed “Shale Gas Insight” in Philadelphia Sept. 7-8.

Chesapeake Energy’s McClendon and CEOs of other energy companies, including Range Resources and CONSOL, will participate in this major industry conference, along with Corbett and other pro-fracking politicians. Tom Ridge, the former governor of Pennsylvania, then Secretary of Homeland Security, and now a paid gas industry “advisor,” will give the keynote address.

Plans are already underway for a massive rally outside this convention on Sept. 7 and a conference for anti-drilling activists on Sept. 8. These actions are being called “Shale Gas Outrage” days. More information is available at www.shalegasoutrage.org.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment